Sick of waiting an eternity for payments, or having fees slurp up your income? You’re not alone. Freelancers around the world face payment delays and lose money in bank fees and terrible exchange rates. It is frustrating, to put it mildly.

But guess what? There’s a smarter option. A type of cryptocurrency that maintains a stable value, stablecoins are making payments for freelancers around the world faster, safer and cheaper.

This guide will explain how stablecoins let you simplify payments and keep more of your hard-earned money. Ready? Let’s get started!

What Are Stablecoins?

Stablecoins are, well, stable, relatively speaking, and you would not believe how important that is. Stablecoins, unlike Bitcoin or Ethereum, which can bounce up and down in price, are supposed to remain stable. The idea? To be able to meld the crypto speed and ease with the reliability of regular money.

Here's how they work: stablecoins are typically pegged to something stable, like the US dollar or gold. This tethering, known as a “peg,” helps maintain their value in a predictable range.

Here are some popular stablecoins:

- USDT (Tether): One of the earliest and most extensively utilized, pegged to the US dollar.

- USDC (USD Coin): Transparent and redeemable 1 to 1 for real dollars in reserve.

- DAI: A stablecoin pegged to the US dollar that is managed by smart contracts on the Ethereum blockchain.

So, stablecoins are like the placid waters of an always choppy crypto sea. They’re excellent for payments, for saving money or sending money around the world.

How Do Stablecoins Stay Stable?

There are several types of stablecoins that have varying methods of stabilizing their value. Here are the three primary categories:

Fiat-Backed Stablecoins

They are secured by traditional currencies such as the US dollar or euro. Each coin has a corresponding amount of money in a bank. In the case of USDT, for instance, 1 USDT is equal to $1 in reserve.

Commodity-Backed Stablecoins

These are backed by assets such as gold or silver instead of cash. So the value of the stablecoin is backed by something tangible, like a stockpile of gold.

Algorithmic Stablecoins

These operate a bit differently. They don’t depend on physical reserves. Instead, they rely on algorithms and smart contracts to regulate supply and demand, stabilizing their value.

Both types have their own pros and cons, but they appear to all share one common goal: stability. That is why stablecoins work for freelancers, businesses and anyone else looking for a secure, simple way to manage cash.

How Freelancers Benefit From Stablecoins

You may be asking yourself, “Why use stablecoins for freelance payments?”. Stablecoins can actually make life a lot easier for freelancers. Here’s how:

- Fast Online Payments That Don’t Leave You Hanging

Ever waited several days for a wire transfer to process? Annoying, right? International payments through traditional banks can take 3–5 business days. Weekends? Even slower.

Stablecoins don’t follow those rules. Blockchain enables 24/7 secure digital payments. Your payment goes through almost immediately, whether it’s Sunday night or Tuesday morning. Bank hours do not apply and neither do time zones. Just fast payments, on-demand.

- Reducing Fees with Stablecoin Payments

Freelancers are aware of how fees can accumulate. PayPal or wire transfers usually carries big fees for processing or currency conversion.

Stablecoins change the game. They keep fees way low, sometimes just pennies versus the old, throw-a-bunch-of-money-at-it ways of doing things, by cutting out the middleman. More in your pocket, less given to fees.

- Safer Digital Payments for Freelancers

Worried about fraud? Or chargebacks screwing up your cash flow? Stablecoins have you covered with digital payment security.

Every transaction is secured with complex encryption thanks to blockchain technology. Once a payment has been made, it’s added to the blockchain and that block is locked. No tampering. And no chargebacks. Your paychecks; they belong exactly where you tell them to stay.’

- Easier Cross-border Payments with Stablecoins

Dealing with clients abroad? Stablecoins make it simple.

No more currency conversions or unforeseen fees. Your clients pay you directly in stablecoins and you receive precisely what you’re due. No deductions, no headaches. It’s an easy way to work with anybody, anywhere.”

The Bottom Line?

Stablecoins aren’t just another way to get paid, they’re a better way to be paid. Reduced fees, quicker transactions, and fewer hassles means more time focused on what really matters: Your Work.

Step-by-step Guide to Using Stablecoins for Payments

Want to get paid in stablecoins as a freelancer? Great! We’ll break it down into steps so that you can jumpstart your way through without any stress.

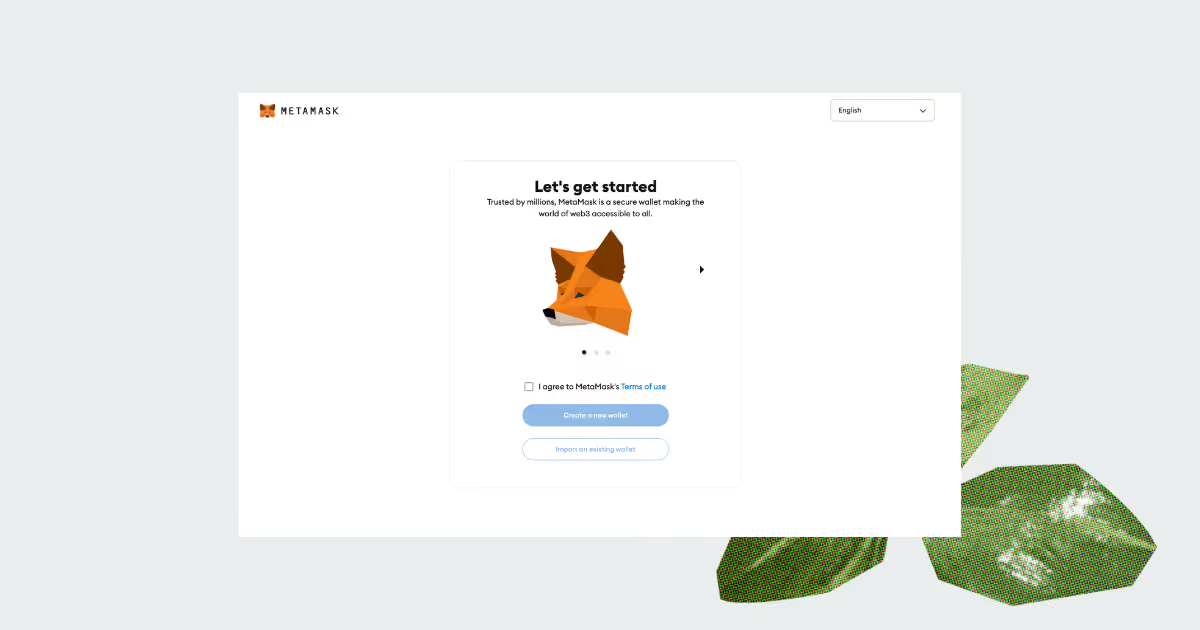

Step 1: Set Up a Wallet

A digital wallet is like your safe for stablecoins. It’s safe, user-friendly, and vital for your onboarding. You can check out some of the popular options like MetaMask and Trust Wallet, both of which are great for new users.

Here’s what to consider when choosing the right wallet for stablecoins:

- Simplicity: Choose a user-friendly and convenient interface. You’re thinking of seamless transactions, not a technology riddle.

- Security: Ensure the wallet has strong security features, such as 2FA (two-factor authentication). Your income needs to be vigorously protected.

- Compatibility: Make sure the firm’s digital wallet supports the stablecoin you want to use. Not all wallets support all coins.

After your wallet is set up, you can begin receiving stablecoins from clients or various platforms. It’s that easy!

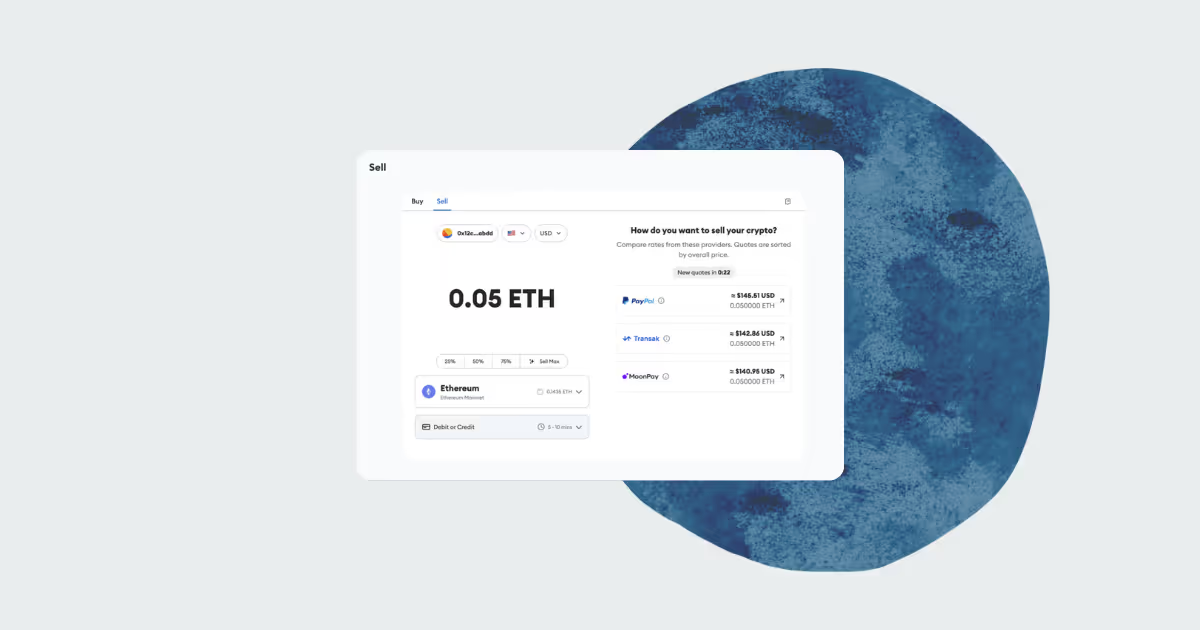

Step 2: Convert Stablecoins to Cash

Want to convert those stablecoins to local currency? No worries. It’s easy, thanks to platforms like Coinbase and Binance. Here’s how:

- Move stablecoins from your wallet to an exchange.

- Sell them in your local currency.

- Transfer the funds to your bank account.

Other platforms like Kraken or Bitstamp also work just as well, depending on your geographic situation. And a pro tip: Make sure to review fees and processing times ahead of time when you pick a platform.

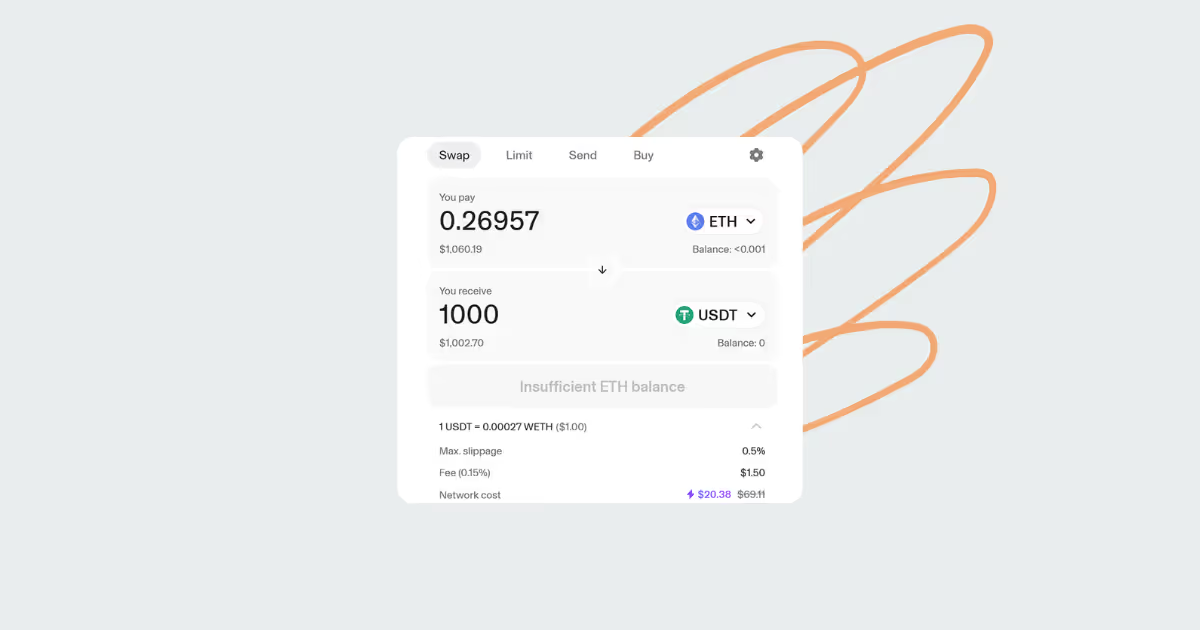

Step 3: Choose The Right Stablecoin

All stablecoins are not created equal. Here’s how to choose one that works for you:

- Stability: Search for coins such as USDC or USDT, which are pegged to the U.S. dollar. They are trusted and easily accepted.

- Low Fees: When transaction fees are high, they subtract from your income. Choose a coin that has low costs.

- Convertibility: Ensure it’s easy to convert the coin for cash when necessary.

If you’re a newbie, USDC and USDT are solid choices. They’re simple to use and widely supported. USDC might have a slight edge, thanks to its recent regulatory approval and broader adoption.

Challenges and Considerations

So, using stablecoins could feel like a no-brainer. But like any tool, they bring their own challenges. Let’s break them down:

Regulatory Concerns

In many countries, stablecoins reside in a legal gray zone. Why? Because they confuse currency with financial assets.

And if you're freelancing across borders, you may have to negotiate taxes, too. For instance, some governments consider stablecoin transactions to be regular income, while others treat them as investments. The crux: If your income comes from stablecoins, you might have to maintain detailed records.

And then there’s compliance. In some areas, services that enable you to turn stablecoins into cash may require you to undergo extensive verification. Gbp stuff, such as proof of ID and proof of funds.

The takeaway? Investigate local rules, and familiarize yourself with any tax laws pertaining to your country before jumping in. A quick consult with a tax pro could spare you headaches.

Understanding Risk of Volatility

Stablecoins are supposed to be stable. But are they foolproof? Not always.

Consider algorithmic stablecoins, for one. They employ elaborate systems to preserve value, but those systems can break down. You recall the collapse of TerraUSD (UST)? It’s a cautionary tale of how algorithmic models can fall apart when under pressure.

There are definitely risks even with fiat-backed stablecoins. If the managing company is less than transparent or lacks proper reserves, they could be valued at a fraction of their worth.

So, even though the word “stable” is in the name, do your research. Stick to the trusted ones like USDC or USDT if you are new.

Technology Barriers

C’mon, let’s be honest: crypto tech can be daunting. Wallets, keys, blockchain networks, all of it can be overwhelming.

Whose usage, for example, needs to be managed carefully. If your private key gets lost, your funds could be lost forever. And trading stablecoins on decentralized platforms? That takes practice.

For someone unfamiliar with crypto, this learning curve may feel steep. But here’s the other good news: there are beginner-friendly tools. Several wallets and exchanges have also made the process simpler by designing user-friendly webpages, and providing easy step-by-step guides.

Start small. Learn as you go. And if you get stuck, don’t be afraid to ask for help.

Frequently Asked Questions About Stablecoins

What is a stablecoin and how is it different from bitcoin?

A stablecoin is a kind of cryptocurrency that is oriented to have a constant worth, usually linked to a fiat currency like the United States dollar. Unlike Bitcoin, whose price can vary widely, stablecoins seek to avoid volatility. They are the steady ship in the often-stormy waters of crypto.

Is the freelancer stablecoin transaction taxable?

Yes, in most cases. Similar to standard payments, a stablecoin transaction may or may not be taxed. The rules differ depending on where you live. Which brings in differences between countries – for example while some treat crypto income like regular income others can have specific regulations. To stay safe? Document all your transactions and seek advice from a tax professional.

How should I store stablecoins to ensure the safest option?

Our safest bet is a cold type wallet, which is a hardware wallet that is not connected to the internet. This protects your stablecoins from hacks. Some hot wallets (online wallets) offer strong security features, too, if you value convenience. Just remember to turn on two-factor authentication (2FA), and use a unique, strong password.

Can I bill clients in stablecoins?

Invoicing in stablecoins is a bit tricky, but there are platforms like Ruul, which allow you to invoice your client in fiat while handling payouts in stablecoins using Merchant of Record (MoR) services built specifically for freelancers. This setup will make everything flow more easily and comfortably for you and your clients.

How long does it take to get paid in stablecoins?

One of the advantages that stablecoins offer is speed. Depending on which network is used, transactions are generally executed within minutes. By contrast, bank transfers can take up to several days or even weeks, especially for international payments.

Conclusion

Stablecoins sir, freelancers’ new ally. They make payments quick, secure, and cheap, none of that waiting around for days or paying exorbitant fees for international transfers. And on the strength of blockchain tech, each transaction feels a hell of a lot safer.

Do you think stablecoins could work for you? It’s worth exploring. They’re a savvy approach to streamline payments and access global opportunities.

Ready to give them a try? With Ruul's crypto payout feature, getting paid in stablecoins is a breeze. It sets up quickly, isn’t the rigid set-up of so many, and is designed for freelancers specifically.

Check it out today to see how the best stablecoins can redefine your salary!