Before you begin your freelance job, you should have a good process in place that protects your work and pays you. Think of it as a pre-flight checklist. If you don't buckle in properly, your freelance income can get bumpy, if not downright unpleasant. Just a saying!

Setting the stage: The 6 essential pre-payment steps

Now, let's check out these 6 basic pre-payment steps together! 👇🏻

1) Define the scope and pricing

If both the scope and pricing are unclear, you can virtually guarantee a stealthy form of "scope creep" (in which the project subtly expands out of what was agreed)!

Here’s how to help you safeguard yourself from one of the biggest killers of a freelancer’s income.

Create a job Statement of Work (SOW)

Creating an SOW for every project is the key to surviving as a freelancer.

Otherwise, you may receive comments such as “I asked for this too!” 🤨 or have to say “Well… the actual payment date was today." (even if you did say it before).

This eliminates any confusion between the promised and delivered product or service once the project concludes.

If you’re not sure how to set your rates, use Ruul’s freelance hourly rate calculator. This way, you’ll get a customized hourly rate suggested by Ruul for each project.

2) Get it in writing

The project description can’t be vague or just live in people’s minds!

If "spoken words are silver," then "contracts are gold." To protect yourself legally, be sure to have your terms documented appropriately.

Remember that a contract isn't to start a fight, it's to clear the air. Even if your client is the sweetest person ever, it's still the best decision for both of you.

Don't feel bad about it.

A contract protects you when:

- The client cancels the project,

- Feedback is delayed, or

- Payment is late.

Don't let the word "contract" scare you. It doesn't have to be hard. Most of the time, a simple contract template that can be reused is all you need. You can tweak it as new projects come up.

If you’ve never made a written “Statement of Work” before, try Ruul’s free Service Agreement Generator tool.

Remember: clarity today prevents conflict tomorrow.

3) Set up your payment ecosystem

Decide how you’ll get paid before starting the project, and make sure your client knows it.

Will you use:

- a bank transfer,

- a payment processor (like PayPal or Wise),

- a crypto platform (like Binance, supported by Ruul), or

- a Merchant of Record (MoR) platform like Ruul?

Let’s say you didn’t discuss the payment method at the start. When the project ends, your client suggests a method that doesn’t work for you. Then you offer another option. but now the client has to set up a whole new payment app. 🤨 A terrible dispute!

That’s why it’s best to agree on a simple, reliable, and compatible payment method from the beginning. With Ruul, your customers won't have to sign up for a platform, so there won't be any confusion. Just send the link, and they can pay seamlessly.

4) Create a professional invoice template

Issuing an invoice is very professional, to track your income, earnings for tax purposes, and refuting liabilities.

You can use a basic and branded template to send out bills on everything you complete.

Every invoice should include:

- Your details (name, address, tax ID)

- Client details

- Project name (e.g. Logo Design)

- Currency (USD / EUR / TRY)

- Tax note (e.g. “All fees are exclusive of VAT”)

- Due date (e.g. “2% per month after due date”)

- Payment method (bank transfer, crypto, etc.)

Pro tip: Keep a simple numbering system (for example, INV-2025-001), remember when you sent each invoice, and when it was paid. This will make your year-end reporting a breeze.

I know, sending an invoice manually seems like a pain for freelancers. But, if you didn’t start doing that, that’s okay, (but) you should do it once you have a consistent income! There are plenty of tools that will help you, so don’t worry.

🤝🏻 If you are using Ruul, you already have a built-in invoicing tool! You can create invoices that are instantly legally compliant (including currency and VAT breakdowns), and send them to clients, anywhere globally, without worrying about formats or cross-border rules.

5) Clarify taxes and currency

If you only work within your own country, VAT and currency may not be a big deal. But if you work internationally, exchange rates or tax obligations can catch you off guard!

Decide early:

- What currency you invoice in, and

- Whether your price includes VAT, GST, or withholding tax.

🤝🏻 Ruul automatically adapts your invoice to local tax laws, applies the correct VAT or GST when needed, and even displays the client’s currency. No manual setup required.

Example:

You’re in Türkiye and your client is in Germany.

If you agree on €1,000:

- Invoice in EUR to avoid conversion loss

- Mention “VAT not applicable under reverse charge”

- Payment via Ruul ensures compliant processing automatically.

6) Confirm the schedule

To get your invoices paid on time, and still make it to parties, choose the best payment schedule for you!

You can typically invoice smaller projects all at once. But with the bigger projects, you may want to structure a payment plan to protect your cash flow and safety.

I share the top 3 payment schedules for freelancers!

a) 50/50 rule

To start, most freelancers utilize a 50% upfront and 50% on delivery system.

This is a common standard system because it is straightforward, and most clients feel comfortable with it. Usually, the system operates smoothly.

Having this upfront fee balances the project out and gives the client some comfort knowing the paid fees are directly related to the work they receive. For freelancers, it protects them from spending hours on unpaid work.

🚩 Red flag: Never start large projects without an upfront payment. If a client avoids deposits, it’s a sign to reconsider the collaboration.

b) Milestone-based

This method will work best for the larger projects. This means you will receive payments in proportion to each major step of the project.

Ex. (Logo Design Project):

- 50% upfront (concept stage),

- 30% after draft revisions,

- 20% upon final files delivery.

Whatever system you use, it means nothing unless it’s in writing. Include your pay schedule in the contract and explain it upfront. That simple step eliminates irregular pay and turns each project into a predictable payment.

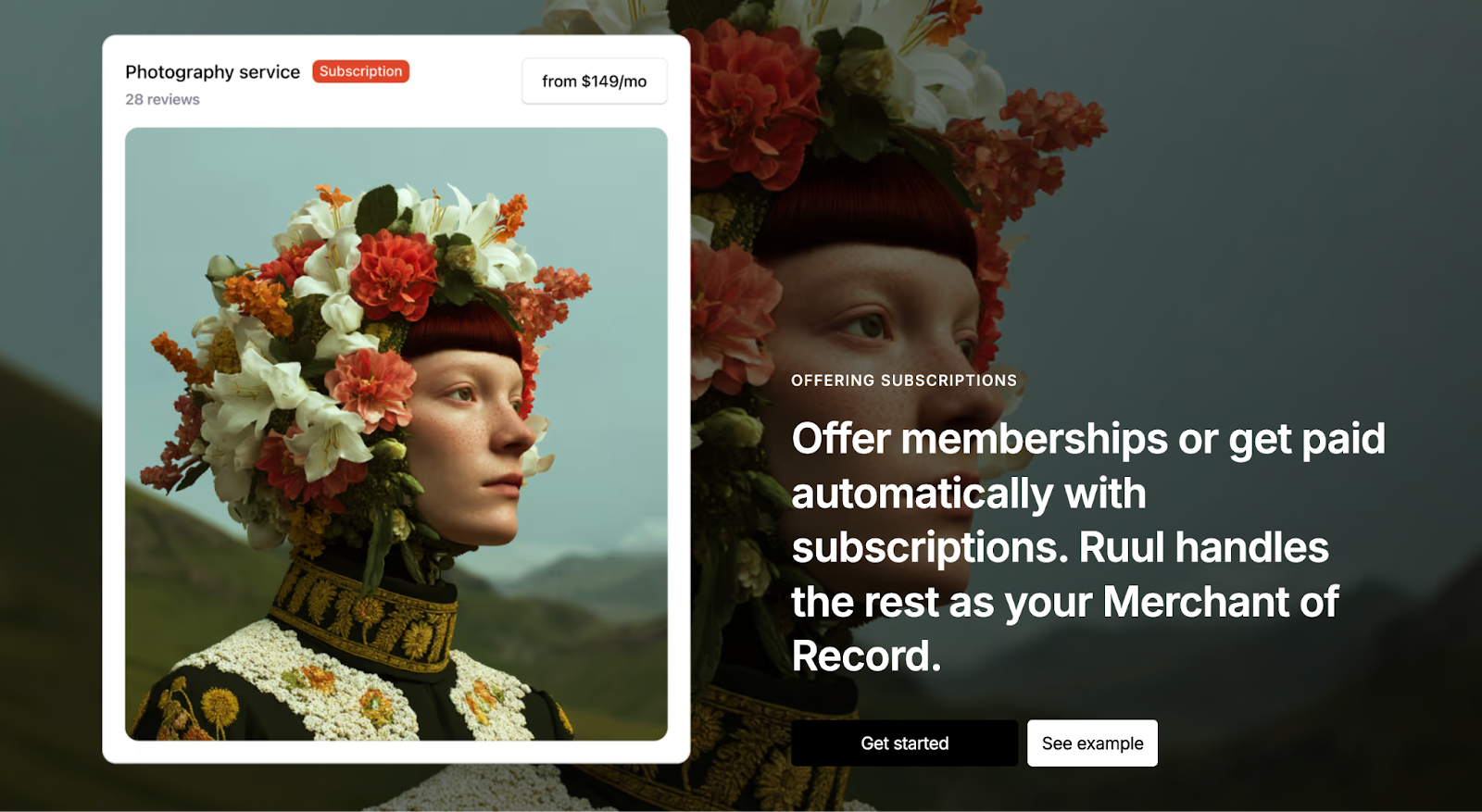

c) Subscription-based

If you're looking for predictable income, subscription payments are definitely the way to go! Honestly, it's my personal favorite, and freelancers love this newer way of working!

It basically means:

— A client buys your services each month, and a fixed amount of work or hours can be set.

Examples:

- Monthly payment for 20 working hours

- Monthly payment for 10 social media posts

- Monthly payment for LinkedIn account management

🤝🏻 With Ruul, you can sell subscription like a Netflix. Invoices are issued automatically, no manual reminders (zero follow-ups and your income becomes predictable. Clients tend to stick around too, because a clear system means less stress for everyone.

Best payment methods for freelancers

Don’t pick a payment method at random. You need to balance cost and legal compliance. The wrong choice can lead to high fees or compliance issues.

You'll choose based on:

- Client's country,

- Company size (enterprise/B2B or startup), and

- Your ability to keep up with international tax laws.

Three common payment methods freelancers use:

- Payment Processor (e.g., PayPal, Wise)

- Merchant of Record (e.g., Ruul)

- Direct Bank Transfers

Let’s figure out, step by step, which one is the most efficient and secure for you.

1) Direct Bank Transfers (ACH / Wire)

I placed a bank transfer on top, as it’s super traditional and simple. The new freelancers will default to it because it feels safe, is simple, and has low fees. But, once your work goes global, unfortunately, bank transfers won't always save you.

- Best for: Freelancers working with local clients in the same country. If both you and your client are in the U.S., ACH transfers are fast, secure, and low-cost.

- How it works: You give your bank account info to the client and the client pays (either for the project or hourly) with a transfer directly into your account.

❌ Bank transfers do not generate invoices automatically, so you will need to use invoicing tools to create and send invoices.

Pros of bank transfer

- Usually, when you are in the same country as your customer, you can get paid right away, or "quickly" without needing to do things with complex payment methods. This is not a burden on your customer, and it is inexpensive.

- “Professional traceability” for bank transfers is a good thing. They’re good because, for example, bank transfers can serve as official proof of income, which is favorable for visa applications, loans, and leasing.

Cons of bank transfer

- Customers face challenges such as dealing with SWIFT codes for international bank transfers, and each country has its own rules. And also, international payments do not show up in accounts right away, which is a hassle.

- When you're doing an international bank transfer, the interbank exchange rate and hidden conversion fees can add an additional 2-4% to the cost. Some banks even charge fees on both the sending and receiving sides.

- Bank transfers can't automatically create invoices, which means you're going to have a lot of extra money built into those costs as well. You'll have invoicing and tracking income, and document management to do all on your own.

A freelancer’s invoice, tax, and paperwork burden

When you receive your payment by bank transfer, all transactions are under your name.

In other words:

- You issue and keep your own invoices

- You declare your income and pay your own taxes

- You record, report, and file all of this yourself

🔁 When to upgrade? While this system may work just fine for a couple of smaller, local projects. But if your clients are out of the country or you have begun working with multiple currencies, it's time to move to something more globally friendly.

Okay, let's check out other alternatives.

2) Global Payment Platforms (PayPal, Wise, Stripe, etc.)

Global payment platforms are just like bank transfers, but a step up, more flexible, but there’s still a manual step. They’re fairly simple when it comes to cross-border freelancing; however, professionalism and sound fiscal management issues remain.

- Best for: Freelancers who work with global clients but still handle invoicing and taxes themselves. A practical middle ground before switching to a Merchant of Record solution.

- How it works: You and your client both need accounts on the same payment processor (PayPal, Wise, or Stripe). Then your client can send the payment straight to you using just your email (instantly or in 1–2 days).

Pros of global payment platforms

A global payment processor like

- PayPal (200 countries + 25 currencies),

- Wise (160 countries + 40 currencies), and

- Stripe (46 countries + 135 currencies),

enable easy cross-border payments for freelancers. But you'll need to confirm they exist in your country and the country of your client.

Cons of global payment platforms

- You can receive payments worldwide, but only if it's legal in both your and the customer's countries. For example, neither customers nor freelancers in Turkey can use PayPal, Wise, or Stripe. 🥲

- You're still tied down to finances and the law. You've gotta keep track of the documents that establish your income, manage VAT (it's not auto-calculated in any payment tool), and classify your income type, all on your own.

- Big corporate companies generally do not pay their contractors in this way but prefer to pay via invoice, using platforms made for serious business with enhanced invoicing systems. This separates payment processors from the expert professionals.

- You wanted to accept payments via PayPal, but your customer doesn't use PayPal (or Wise or Stripe either), so a dispute is inevitable. Because both of you must have a payment processor account.

A freelancer’s invoice, tax, and paperwork burden

Even if sites like PayPal, Wise, or Stripe might process your payment, they're not your legal seller; you are! That means the legal, accounting, and tax liability still lies with you.

🔁 When to upgrade? When managing invoices, fees, and taxes starts eating into your work time, it’s time to move on. Hello! Merchant of Record solution!

3) Merchant of Record (MoR)

Merchant of Record (MoR) platforms are a legal intermediary that acts as the seller of your service on your behalf. A MoR handles all invoicing, tax compliance, and the collection of payments from clients, so you can put your focus solely on your work and not on paperwork.

Ruul is an innovative payment solution that serves as your Merchant of Record (MoR), handling everything for you. This is the best payment acceptance method on this list, but it's even more than that!

- Best for: Freelancers or creatives working internationally who want to stop worrying about taxes, invoices, and regulations and start getting paid like a global business thanks to Ruul's MoR system.

✅ If you don't want to set up a company but still want to issue tax-compliant invoices and get paid from anywhere in the world, this system is perfect for you.

How it works (5 simple steps)

- You invoice your client through Ruul.

- Your client pays using their preferred method (card, bank, local, or crypto).

- Ruul handles all taxes, compliance, and invoicing on your behalf.

- Receive your payout in your chosen currency.

🤑 Bank transfers are completed within 24 hours, while crypto payments arrive instantly!

❇️ Ruul automates VAT and tax calculations for 190+ countries and ensures every transaction stays compliant with local law in this process.

Pros of Merchant of Record

- Localized Invoicing: With Ruul, your clients receive invoices in a format that looks familiar in their own country. The era of manual invoicing and endless templates is finally over.

- Automatic Tax Handling: VAT, GST, and withholding taxes are calculated and collected automatically across 190+ countries. No more wondering “What’s the VAT rate?” or keeping up with endless tax updates.

- Global Payment Coverage: No matter where your clients are, you can receive payments in over 140+ currencies (including USDC and local transfers) without opening foreign accounts.

- No company registration needed: Forget about local registrations or reporting in every client’s country. As your legal seller, Ruul handles compliance for you. So you can focus on growing your business.

- Hassle-free payment tracking: Payments are automatically tracked, reconciled, and verified. Invoicing and receipts are handled for you, so you never have to chase clients again. (Goodbye, late payments!)

Cons of Merchant of Record

- If a Merchant of Record platform takes a hefty percentage fee, it can eat into your month, so it is really based on the platform you choose.

❇️ Ruul's fee of 5% per invoice (covering that either you or the client pays) does not have any subscriptions or hidden costs. In the real world, payment processors and invoicing tools are usually a lot more!

For freelancers: Work globally, stress-free

We take away borders and admin hassle for freelancers.

With Ruul, you can instantly create and send invoices.

We handle taxes, regulatory compliance, and customer payments for you.

Whether your client pays in EUR, USD, or cryptocurrency, you'll get paid in your desired currency.

It takes just a couple of minutes to sign up as talent on Ruul.

Join Ruul for less hassle and more freedom!

For clients: Simple, secure, and no sign-up!

Your client can pay your Ruul bill the same way they buy something on Amazon, with a card, bank transfer, or local payment methods. They can even use crypto if that’s easier!

No sign-ups, and no confusion. This kind of simplicity will help you speed up the deal as a freelancer.

In comparison, when it comes to

- compliance,

- freelancer comfort,

- ease of use,

- dispute-free transactions, and

- cost efficiency,

Detailed comparison → Merchant of Record vs. Payment Processor

Staying ahead: The future freelance payment landscape

As 2026 approaches, I want the question “How do I get paid as a freelancer?” to feel much simpler. I’ve gathered what you need to know about the future of freelance payments under four key points.

📌 In 2025 and beyond, these regulations will get even stricter. A single mistake could lead to financial or legal consequences.

1) VAT/GST requirements in different regions

As a freelancer, your obligation to calculate VAT (or, depending on the country, GST or sales tax) starts when your work turns into a regular business activity.

- If it’s occasional or a hobby → you usually don’t need to charge VAT.

- If it’s a regular service → you’re considered a business, and VAT applies.

However, each government sets its own legal thresholds for VAT registration.

For example, France says:

— “If you earn over €34,400 per year, VAT/GST registration is required.”

But these thresholds and requirements change all the time. France, for instance, plans to lower it to €25,000, meaning many freelancers will have to start invoicing earlier.

That’s why you need to stay updated on different regional rules.

If you issue invoices using MoR platforms, they automatically comply with these changes as legal sellers (Ruul does it). This way, you don't have to keep track of legal changes.

2) U.S. Tax Forms (W-8BEN)

If you’re providing services to a

- U.S. company,

- platform, or

- client, and

you’re not a U.S. citizen or don’t have a U.S. business, you’ll need to fill out the W-8BEN form.

By completing this form, you’re declaring:

— “I’m not a U.S. citizen and not subject to U.S. taxes.”

If you don’t submit it, the U.S. company is required by law to withhold 30% tax from your payment (known as withholding tax). If you do submit it, the withholding rate is 0%.

Get information about the W-8 BEN form from the IRS.

Freelance payment checklist

That checklist you review before every project 👇🏻

- Define the project scope and rates clearly

- Include delivery date, method, and scope in a written agreement

- Decide the payment method and currency before the project starts

- Issue a legal, branded invoice for every transaction

- Check taxes/VAT based on each client’s country

- Offer multiple payment options to your client

- Receive, record, and store payments securely

FAQs

1. How do you get paid as a freelancer?

Freelancers get paid via direct bank transfers, global payment platforms, or Merchant of Record (MoR) solutions like Ruul. MoR handles invoicing, taxes, and compliance, ensuring fast, secure, and borderless payouts in multiple currencies.

2. Do freelancers pay VAT?

Freelancers must pay VAT or GST once they exceed the income threshold. However, tracking changing tax rates and manual calculations pose significant challenges. For this reason, MoR platforms that automatically calculate VAT are gaining popularity.