Imagine a job where your workspace could be your home or a vacation room balcony in the Bahamas. No morning traffic woes or working in a tight cubicle; instead, you enjoy your morning coffee without a rush. (And maybe the most important: no boss to boss around.) Well, this is what freelancing is.

Sure, there are also downsides, but let’s start with the basics. This guide will cover all, so you’ll have all the knowledge and insight you need when you finish this article.

What is freelancing?

The word “freelance” dates back to the early 19th century, originally describing a mercenary—a “free lance”—who fought for whoever paid the most, rather than pledging loyalty to one lord. Cool story.

While the context has shifted dramatically, the core idea remains:

→ Freelancers offer temporary or project-based services without being bound to one organization.

Today, freelancers span many industries: writers, marketers, developers, consultants, designers, and more. Anyone who can deliver services or products on a contractual basis can be considered a freelancer.

When you work as a freelancer, taxes are under your responsibility.

Ruul, as a merchant of record, can help you make it easy to sell services and stay compliant.

Regardless of which path you take, one thing remains consistent: you're in charge of your taxes, business operations, and long-term direction.

💚 Ruul helps simplify this process, handling invoicing, international payments, and compliance so you can focus on what you do best.

In 5 steps: How does freelancing work?

Freelancing unfolds in five steps:

1. Finding clients

What to do: Seek work through your preferred channel, such as online platforms, networking, referrals, or personal websites.

This is the most difficult part for almost every new freelancer.

Many freelancers turn to freelance marketplaces like Upwork, Fiverr, or Freelancer.com at this point. However, these platforms are quite saturated, and it can be hard to get the first client.

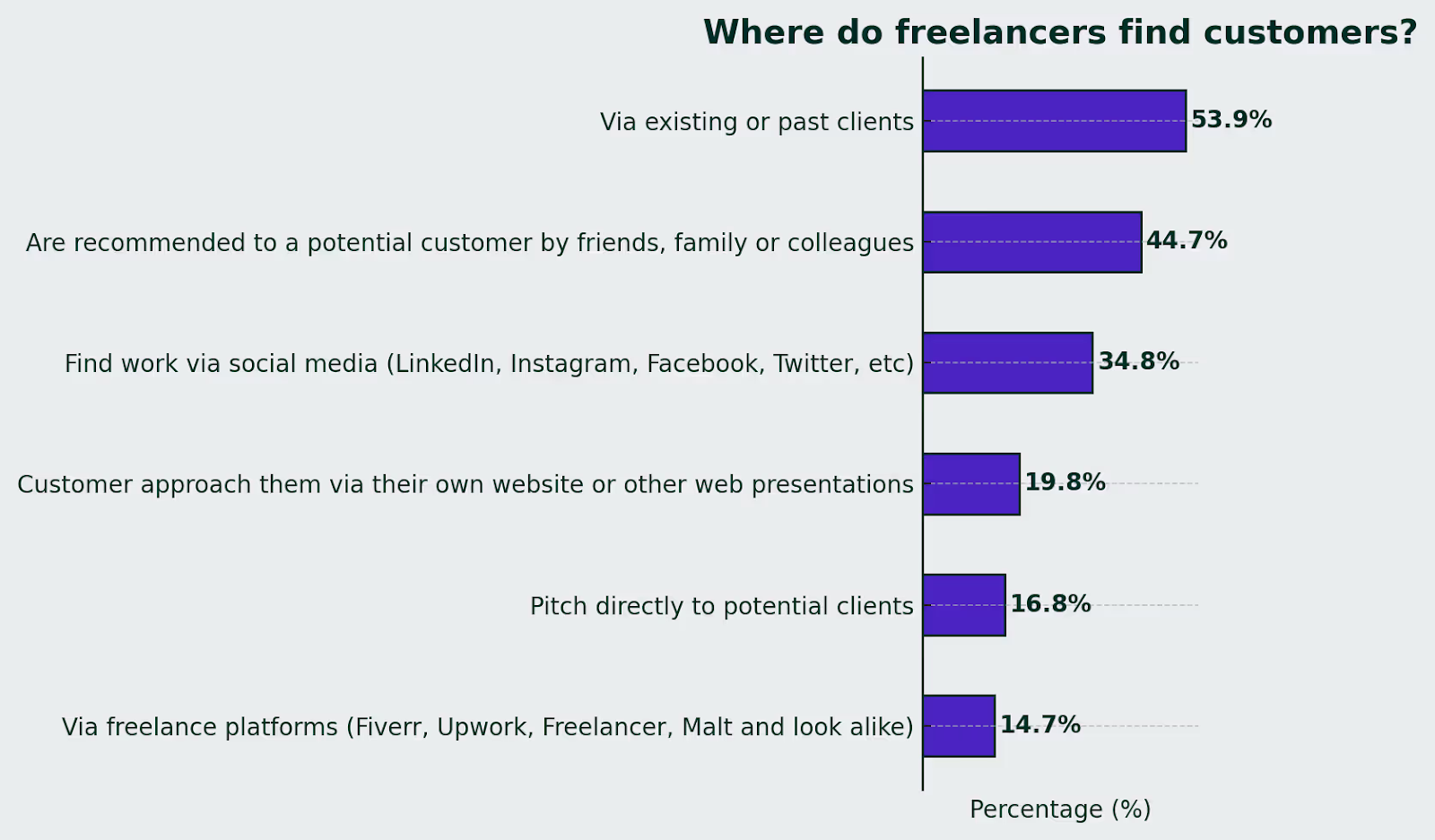

You may be happy to know that these platforms are not the biggest contributors to freelancers’ incomes.

See this graph:

Let me tell you about alternative ways to find your clients:

- Networking through friends, former colleagues, or communities

- Referrals from people you’ve worked with in other settings

- Your own website or social media, like LinkedIn or Instagram

- Your portfolio link (with a payment button with Ruul Space)

See this graph illustrating the answers to the question of “where do you find your customers as a freelancer?”:

2. Negotiating terms

What to do: Discuss project scope, deadlines, payment rates, and other expectations before starting work.

Once someone’s interested in working with you, it’s time to set expectations. You need to be clear about:

- What the project covers

- What it doesn’t cover

- Deadlines

- Pricing

- Communication methods (email, Slack, video calls, etc.)

At this point, you will need to decide on your pricing type: per-project or hourly rate.

- If the time and effort for the project are clear from the beginning, go for project-based pricing.

- If there are uncertainties, hourly pricing is safer for you.

3. Delivering work

What to do: Complete tasks independently and meet deadlines and quality expectations.

Deliver the work as agreed upon when you both embarked on this journey together.

No doubt, you’re a human, there can be some complications and delays. What really matters is efficient and timely communication and proactive action with responsibility.

📍 Clients don’t expect perfection. They expect honesty and responsibility.

Make sure your final delivery is clean, complete, and easy for the client to use. A great delivery leads to trust and often repeat work.

4. Managing finances

What to do: Manage your own invoicing, payments, taxes, and expenses.

Freelancers have to manage their own money.

That includes:

- Sending invoices

- Accepting payments

- Tracking expenses

- Paying taxes

If you're using platforms like Upwork or Fiverr, keep in mind that they charge up to 20% in service fees. But this doesn’t cover your taxes. You're still responsible for reporting your income based on your country’s rules.

To simplify things, you can use a merchant of record platform like Ruul, which helps with:

- Invoicing

- Global payment processing

- Tax compliance

The beauty of Ruul comes from its compliance with global sales tax regulations.

5. Building client relationships

What to do: Maintain good communication, ensure client satisfaction, and secure repeat business or referrals.

Getting a client is hard. Keeping one is easier and way more valuable.

When you do great work, communicate clearly, and act professionally, you make it easy for clients to trust you. That’s how you get repeat projects and referrals.

You don’t need dozens of clients to succeed. In fact, a few long-term clients can be much more sustainable than chasing new ones every month.

So, follow up after projects, ask for feedback, and be someone they’d want to work with again.

Top 5 real perks of starting your freelance career

If you’re thinking about going solo, here’s what you can genuinely look forward to. 👇🏻

- Work on your own terms: Freelancing lets you decide when, where, and with whom you work. That’s why about 1.57 billion people choose freelancing worldwide.

- Control your income: You decide how much you charge and how many projects you take on.

- Skip the office politics: Freelancing strips away the unnecessary noise so you can focus on doing the actual work.

- Build a career that grows with you: Over time, each project contributes to a growing personal brand (and increases your prices gradually).

- Do what you actually enjoy: This means your work aligns with your interests, not just a job description. That’s where real motivation comes from.

6 challenges to evaluate

Well, there are also things to consider. Things aren’t always sunshine and rainbows.

1. You're responsible for everything: As a freelancer, you’re running a business. That means you handle your own pricing, proposals, client communication, taxes, contracts, and deadlines.

Discover Merchants of Record (See: What is MoR?). They handle the sales taxes related to your client transactions, so you don’t have to deal with that side of things.

2. You won’t earn a stable income right away: One month you might be swamped with work, the next month might be quiet. That’s normal, especially in the beginning. These periods are when you build your strategy and start being visible.

3. Building your reputation takes time: You probably won’t land your dream client on day one. In the beginning, you might need to accept smaller jobs just to prove yourself and build a portfolio.

But each successful project adds credibility. If you consistently deliver good work and act professionally, clients will remember you. Some will come back. Others will refer you.

4. Work-life balance can get messy: When your home becomes your office, the line between “on” and “off” can disappear. Some freelancers work late into the night. Others struggle to get started without structure.

5. It's hard to say no when work finally starts coming in: When you start getting offers (especially well-paid ones), it’s tempting to say yes to everything. But overcommitting can hurt both your mental health and your work quality.

Can you just quit your job and freelance full-time?

It depends on your conditions. If you have savings or a financially supporting partner or family, why not?

But when you’re just starting, your income might be unpredictable. Clients might ghost you. Payments might be late. Don’t count on stability in the first 6–12 months. If you can afford this, go for it. If not, wait until you have one or two approved sales processes.

That’s why most freelancers start on the side and only go full-time once their income is:

- Consistent (3–6 months in a row)

- Enough to cover savings, taxes, and living expenses

However, the challenge is that when you invest more time in finding clients, stability can arrive earlier. So it’s up to you to decide.

What are freelance opportunities?

The number of companies working with freelancers is on the rise, which means more opportunities in the freelance world.

Would you guess that around 46% of China’s workforce is self-employed?

Why do businesses choose freelancers?

- They can manage costs by hiring on a project basis.

- Freelancers provide quick solutions for urgent tasks.

- It’s easier to find specialists for specific needs.

- Cultural diversity and different perspectives add value to projects.

Plus, the traditional 9-to-5 work model is losing its appeal.

Digital-native Gen Z professionals, in particular, reject the idea of being tied to an office and find freelancing more flexible and practical.

- 52% of Gen Z are freelancers.

- Compared to 44% of Gen Y (Millennials).

So, if you’re a passionate Gen Z professional, carving out your place in the growing freelance market could be the key to the freedom you’re looking for.

30+ popular freelance jobs

Convinced to move on? Here are some popular freelance jobs.

1. Creative Design

If you love creating visuals, these roles let you bring ideas to life:

- Graphic Design: Create logos, social media visuals, brochures, and more. You’ll work with brand colors and fonts to help businesses stand out.

- UI/UX Design: Design website or app interfaces that are easy and enjoyable to use. Your goal is to make navigation smooth and visually appealing.

- Illustration: Draw images for books, games, or digital media. You can work traditionally or use tools like Procreate or Adobe Illustrator.

- Video Editing: Edit videos for YouTube, TikTok, Instagram Reels, and more. You’ll trim clips, add effects, and make content engaging.

- 3D Modelling: Build 3D assets for games, animations, or websites. This skill is in high demand in gaming and virtual reality.

- Presentation Design: Help businesses impress by designing clean, professional pitch decks and PowerPoint slides.

2. Writing and Translation

If words are your thing, check out these options:

- Content Writing: Write blog posts, product descriptions, or web copy. Knowing SEO can boost your value here.

- Text Editing: Improve grammar, clarity, and flow in existing texts. Perfect if you have an eye for detail.

- Technical Writing: Create manuals, user guides, or documentation. This requires knowledge in specific fields like software or engineering.

- Translation: Convert content between languages, or add subtitles to videos. Fluency and cultural understanding are key.

- Screenwriting: Write scripts for TV shows, films, or online videos. Niche areas like animation or commercials pay well.

- Copywriting: Craft persuasive marketing text for ads, emails, or product pages that drive sales.

3. Technology and Development

Tech skills open many freelance doors:

- Web Development: Build websites using HTML, CSS, JavaScript, or popular frameworks like React.

- Mobile App Development: Create apps for iOS or Android, from games to productivity tools.

- Software Testing: Test software to find bugs and ensure quality before launch.

- Data Analysis: Turn complex data into easy-to-understand reports and visuals.

- Cybersecurity Auditing: Protect websites and apps by identifying and fixing security risks.

4. Artificial Intelligence (AI)

The AI field is booming:

- AI Model Development: Build AI systems that automate tasks or provide smart insights.

- Chatbot Development: Create AI chatbots to improve customer service and engagement.

- Prompt Writing: Write clear instructions to get the best results from AI tools like ChatGPT or Midjourney.

- AI Consultancy: Help businesses implement AI strategies that save time and cut costs.

5. Digital Marketing

Promote brands and products with these freelance jobs:

- SEO Expertise: Help websites rank higher on Google by optimizing content and structure.

- Social Media Management: Plan and post content, respond to followers, and build brand communities.

- Advertising Campaigns: Create and manage paid ads on platforms like Google and Facebook, optimizing for better results.

- Email Marketing: Design email campaigns that nurture leads and boost sales.

- Content Marketing: Develop strategies and produce content that builds trust and attracts customers.

- Affiliate Marketing: Promote products through referral links and earn commissions. Having an audience helps here.

6. Training and Consulting

Share your knowledge and guide others:

- Online Teaching: Create courses or offer live lessons in your area of expertise.

- Career Coaching: Help people find the right job, improve resumes, and prepare for interviews.

- Personal Development Coaching: Support clients in setting goals, improving habits, and boosting motivation.

- Business Consulting: Advise companies on marketing, strategy, or operations, especially if you have corporate experience.

Pick a freelance job that matches your skills and interests, but don’t be afraid to try something new. Most freelancers build their success by learning, experimenting, and improving over time.

Bonus: Resources to learn more about freelancing

- You may want to watch this TED Talk, which gives some tips about building a freelance career

- See the best podcasts for freelancers. You will stay up-to-date about the field by just listening to them

- Follow us on LinkedIn

Knowing your rights as a freelancer (And why it matters)

What is the "Freelance Isn't Free Act"?

Back in May 2017, New York City passed a law called the Freelance Isn’t Free Act. It was created to protect freelancers. Especially when it comes to getting paid fairly and on time.

The law came to life thanks to a big push from the Freelancers Union, and it was passed unanimously (which almost never happens). That just shows how badly this kind of protection was needed.

So, what does it actually do?

This law says that:

- Freelancers must get written contracts for big jobs

- Clients have to pay on time, even if there isn’t a contract

- And if they don’t? The law is on your side

In short, it’s designed to stop clients from ghosting, underpaying, or stalling payments. All problems freelancers know way too well.

Who is covered by the Freelance Isn’t Free Act?

Not every type of worker is protected by this law. But if you’re a freelancer working in NYC, there’s a good chance it applies to you. Here's how to know if you're covered.

✅ You’re covered if…

✔️ You earn 1099 income

This just means you're not an employee, but someone who works for themselves. You probably fill out a 1099 form during tax time if you do freelance work, gigs, or contract jobs.

✔️ You’re owed $800 or more within 120 days

If you’ve done freelance work for a client that adds up to $800 or more in a 4-month period, this law kicks in. That could be from one big project or a few smaller jobs.

✔️ You’re a sole proprietor or a one-person business

If you're running your freelance work under your own name (and don’t have employees), you're likely a sole proprietor, and you’re covered.

You can also be covered if you’ve registered your freelance work as a:

- LLC

- S-Corp

- C-Corp

As long as you’re the only worker and don’t have any employees, you’re still protected by the law.

❌ Who’s not covered?

The Freelance Isn’t Free Act doesn’t apply to everyone. You’re not covered if you fall into one of these categories:

- You’re an employee (you get a W-2 from your job)

- You run a business with employees

- You’ve formed a partnership (you and one or more people run the business together)

- You work in law or sales

- You’re a city or government employee

The future of freelancing is already here.

What used to be a side hustle is now a full-time career for millions.

As Gen Z enters the workforce and redefines what “work” should look like, freelancing is becoming the new norm. People want autonomy, purpose, and flexibility, and they’re building careers that reflect that.

The best part? The barriers to entry are lower than ever. Platforms like Ruul make it easy to handle the logistics: invoicing clients (yes, even internationally), accepting crypto, managing late payments, and staying compliant with tax rules.

That’s no longer the hard part.

The real challenge now? Finding quality clients. Keeping them. And building a personal brand that sets you apart in a global talent pool.

Whether you’re just starting out or aiming to scale, freelancing requires more than talent. It requires strategy. If you approach it as a job, you will be preparing yourself for an extremely satisfying career.

We’re rooting for you. 🤝🏻

FAQs

1. What exactly does a freelancer do?

A freelancer offers their professional service to multiple clients without being tied to an office or an employer. They manage their own workload, deadlines, and payments.

2. How do I start freelancing?

Choose a skill that people need and research its demand. You can improve your skills with training and grow your network on LinkedIn. Use good internet, enough storage, and project management tools to stay organized.

3. Is freelancing easy?

Freelancing is hard at first because finding clients takes time. But as you grow, things get easier and more automated. With Trello for planning and Ruul for payments, managing work becomes simple.

4. How do I become a freelancer?

To become a freelancer, first turn your skills into a marketable service. Then, promote your services on social networks like LinkedIn or on marketplaces such as Upwork, Fiverr, and Freelancer.com to find clients.